Services

Tax Refund

Foreign visitors staying in Japan for less than 6 months are not required to pay sales taxes.

Review the list of applicable products and conditions for receiving a tax refund,

and bring any eligible products to the Tax Refund Counter to receive a tax refund.

A service fee of 1.55% of the pre-tax price of the taxed item that you are claiming will apply.

(The tax refund service fee will not be refunded if the product is returned.)

Where to apply

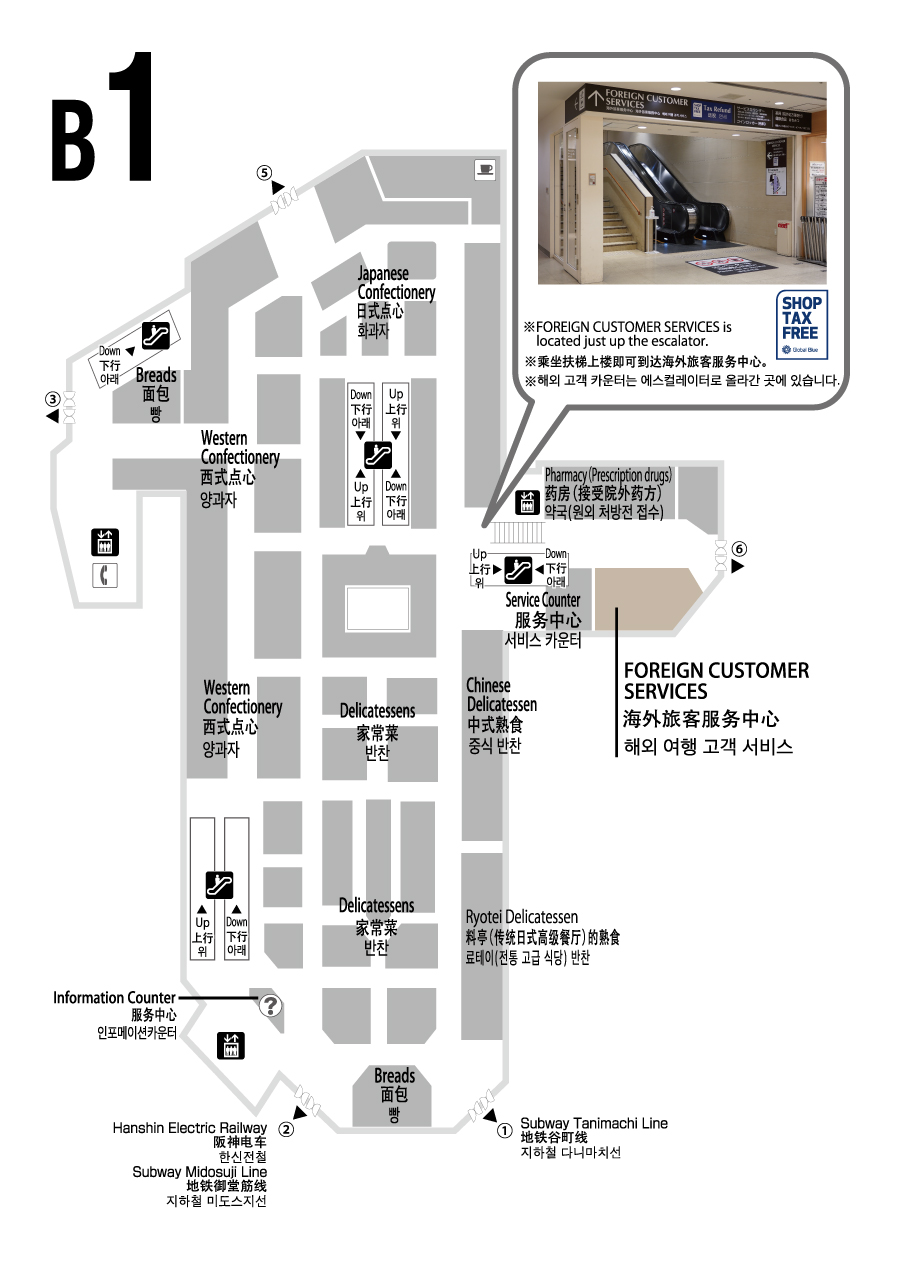

B1

Foreign Customer Services Counter

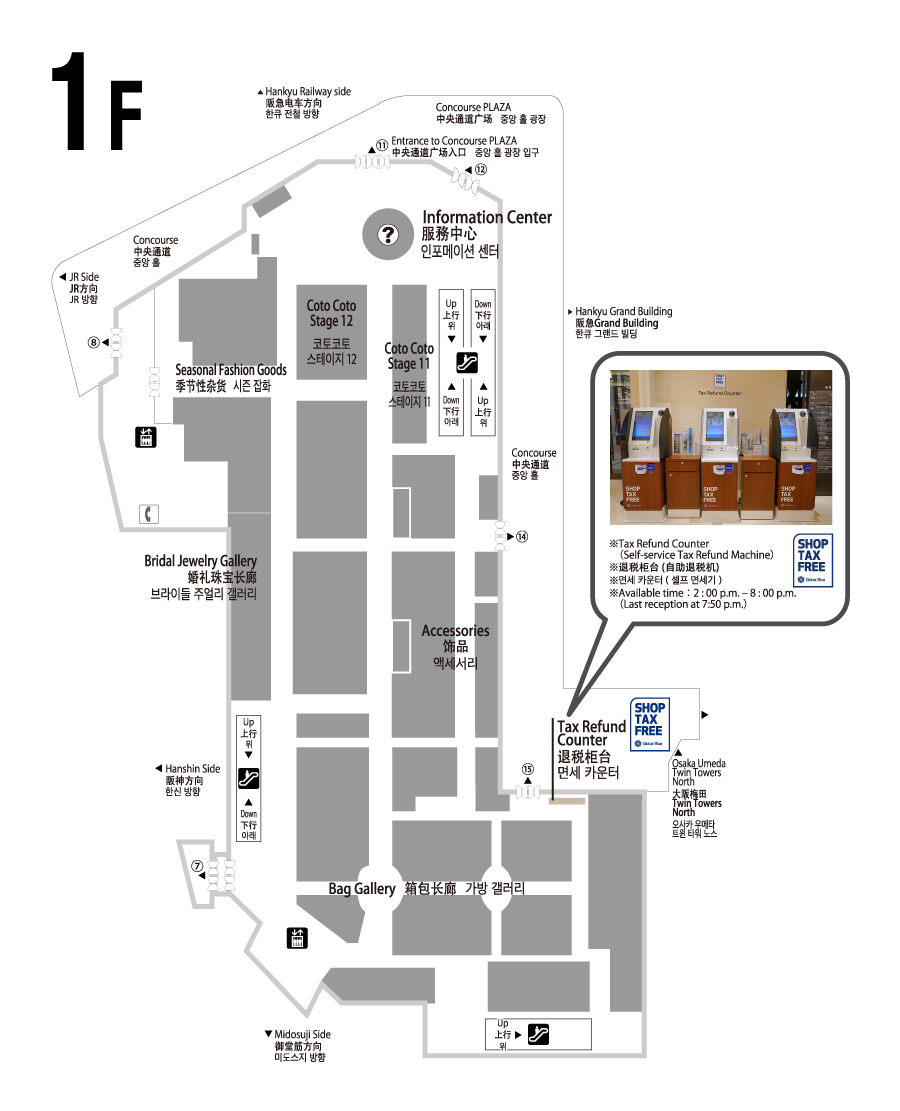

1F

Tax Refund Counter

(Self-Service Tax Refund Machine)

Available time:2 : 00 p.m. – 8 : 00 p.m.

(Last reception at 7:50p.m.)

Eligibility

①Non-resident foreign citizens with “Temporary Visitor,” “Diplomat,” or “Official” visa status who have been in Japan no longer than 6 months. (No proxy applications allowed)

②Non-resident Japanese citizens who can provide documentary proof of residing outside of Japan continuously for at least 2 years. (No proxy applications allowed)

Application Period

Date of purchase only (during business hours)

Tax Refund Conditions

General goods

-

Clothing, Fashion accessories, Watches, Accessories, Household items

- Minimum same-day per-store purchase amount: 5,000 yen (excl. tax)

- Products are not required to be packaged.

Consumable goods

-

Foods, Beverages (incl. alcoholic beverages), Cosmetics, Medicine

- Minimum / maximum same-day per-store purchase amount: 5,000 yen to 500,000 yen (excl. tax)

- Packaged as specified by the Japanese government. Do not open the packaging in Japan. Consuming the items in Japan will require payment of the consumption tax.

General goods

+ Consumable goods

-

- Minimum / maximum same-day per-store purchase amount: 5,000 yen to 500,000 yen (excl. tax)

- Packaged as specified by the Japanese government. Do not open the packaging in Japan. Consuming the items in Japan will require payment of the consumption tax.

Refund Method

- Cash

- Credit Card

(The card user must be verified as the authorized cardholder)

VISA, Mastercard, American Express, Diners Club - UnionPay

- WeChat Pay

- Alipay

Application Procedure

-

Purchasers must bring eligible purchases to the Tax Refund Counter on the same day the purchases were made.

-

The following four items are required.

- Purchased goods

-

Passport (Original only; Immigration stamp required)

- Tax Exemption Card required for diplomats

- Crew Member’s Landing Permit required for crew members

- Non-resident Japanese citizens must provide proof of residing outside of Japan for at least 2 years.(proof of residency or copy of Supplementary Family Register)

- Receipt (handwritten receipts not accepted)

-

Applicable card (when purchasing by credit card, etc.)

- Corporate credit cards will not be accepted.

- Names on the passport, receipt, and card must all match.

-

A refund for the sales tax will be provided after deducting a service fee (1.55%).

-

Be sure to present your purchase and passport to customs when departing Japan.